PERSONAL TAXATION

Individuals having high cash flows are subject to tax default based on their inefficient planning and strategy, which results in paying of taxes at higher rates. Their multiples sources of income render it more complex for them to strategize against higher tax rates. Although in such situation liaison, correspondence and compliance with employer or organization plays a vital role who as additional benefit also file returns on behalf of their employees, however, higher rate of taxes are paid due to ineffective or no linkage between the two. Moreover, having no or less knowledge on recent tax policies, concessions and exemptions, individuals file their return in a conventional manner causing to face huge tax losses. We at Hamza and Hamza assist in planning and claiming tax benefits for individuals to avoid paying higher taxes bases on experience and day to day acquaintance of recent tax policies and circulars to help reduce the risk of default for high net-worth individuals and to assist organizations in fulfilling their assumed responsibilities, we provide services, which include:

- Liaison, correspondence and compliance services with respect to personal taxation.

- Advisory services to help reduce tax exposure or increase tax saving.

- Tax planning and benefits for nationals.

- Tax planning and benefits for Immigrants.

- Tax planning and benefits for Overseas nationals.

- Record Keeping/ maintenance

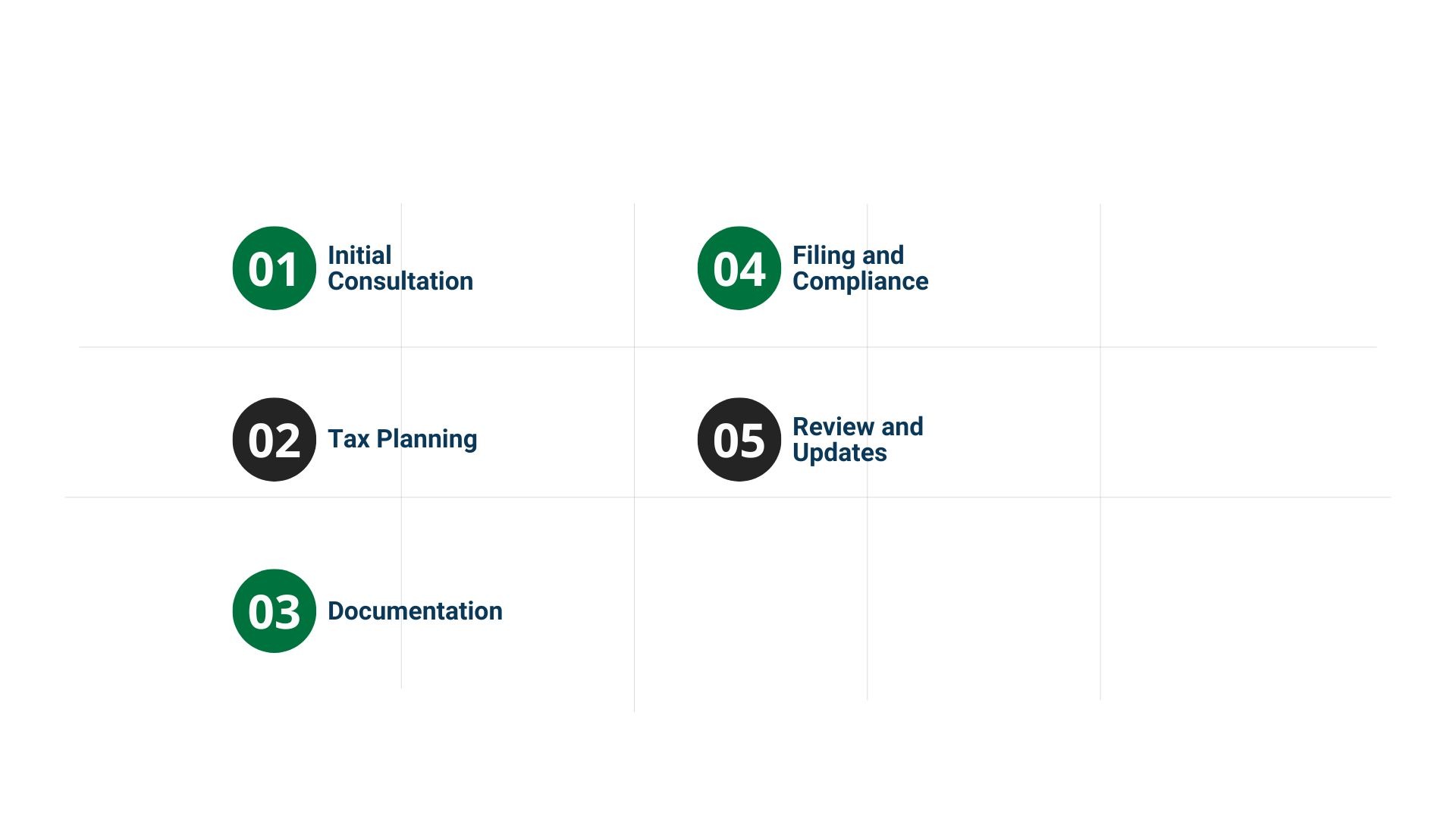

Steps for Taxation Services:

Navigating the complexities of taxation is crucial for business sustainability. IRA Consultants ensures compliance with tax regulations while identifying opportunities to reduce liabilities and enhance financial efficiency, empowering businesses to focus on growth.