CORPORATE TAXATION

Corporate sector has to pay Taxes at high level due to no or less knowledge of recent tax circulars and policies which of course is not only time taking and hectic but complex task to maintain in the larger interest to business. Majority businesses for the purpose hire employees for the job but due to lack of legal tax practice, employee is only able to appease tax burden of business at meager rates. Another important factor causing loss on taxes to business is while filing of returns in conventional manner where inflows and outflows are not maintained as required to benefit business. Significantly another issues is with regard to business to business correspondences and liaison which is also time consuming and cumbersome yet causes business to pay huge taxes at levels which could otherwise be conveniently waived resulting in significant economic benefit. We at Hamza and Hamza provide full range of services to all business sectors leading to significant economic benefit. Services include

- Claiming of Refund and disbursal

- Filling of Tax returns

- Record Keeping/ maintaining

- Tax benefits

- Advisory services including determination of income tax, exemption and withholding tax matters

- Compliance and correspondence services relating to corporate taxation

- Representations before field tax authorities

- Representations before Federal Board of Revenue

- Representations before Courts in appeals

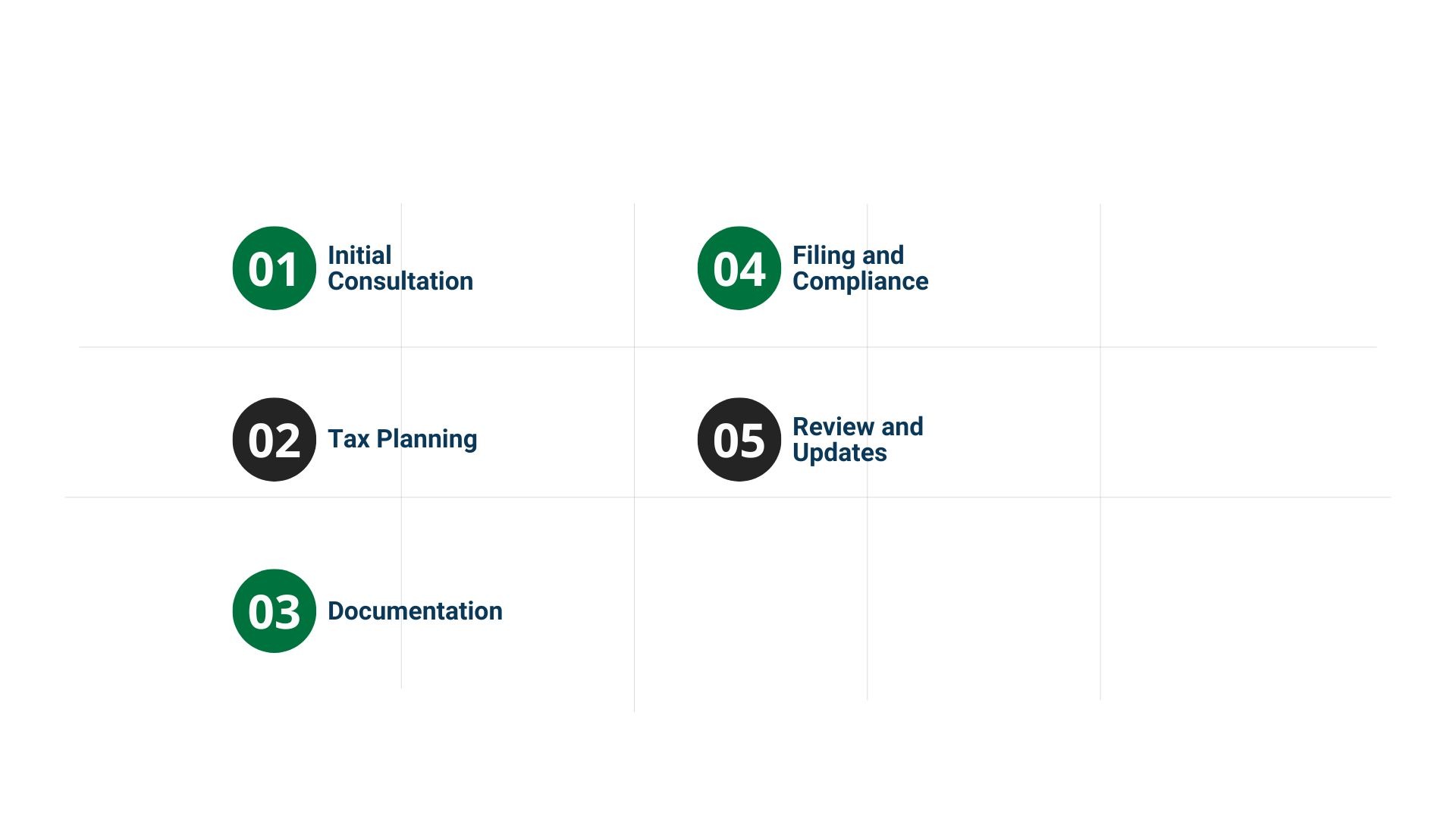

Steps for Taxation Services:

Navigating the complexities of taxation is crucial for business sustainability. IRA Consultants ensures compliance with tax regulations while identifying opportunities to reduce liabilities and enhance financial efficiency, empowering businesses to focus on growth.