Pakistan’s tax regime consists of four main revenue sources including General Sales Tax (GST), Sales Tax on Services (Service Tax), Federal Excise Duty (FED), Customs Duty and Income Tax. Over the recent years Government has emphasized on Indirect Taxes which include Sales Tax of Goods and Services. All manufacturers, Traders and Services provider business entities are required to pay huge amount of indirect taxes on products, items and services respectively. Business entities thus require effective planning and strategy to hit the lowest tax rates to enjoy tax benefits. We at Hamza and Hamza provide wide range of indirect tax advisory services that includes sales tax system evaluation, sales tax audit, and sales tax on services under provincial ordinances and include but not limited to:

- Compliance and correspondence services relating to corporate taxation

- Filling of Tax returns

- Tax benefits

- Planning and Strategy

- Claiming of Refund and disbursal

- Record Keeping/ maintaining

- Advisory services including determination of sales tax, exemption and withholding tax matters

- Representations before field tax authorities

- Representations before Federal Board of Revenue

- Representations before Courts in appeals

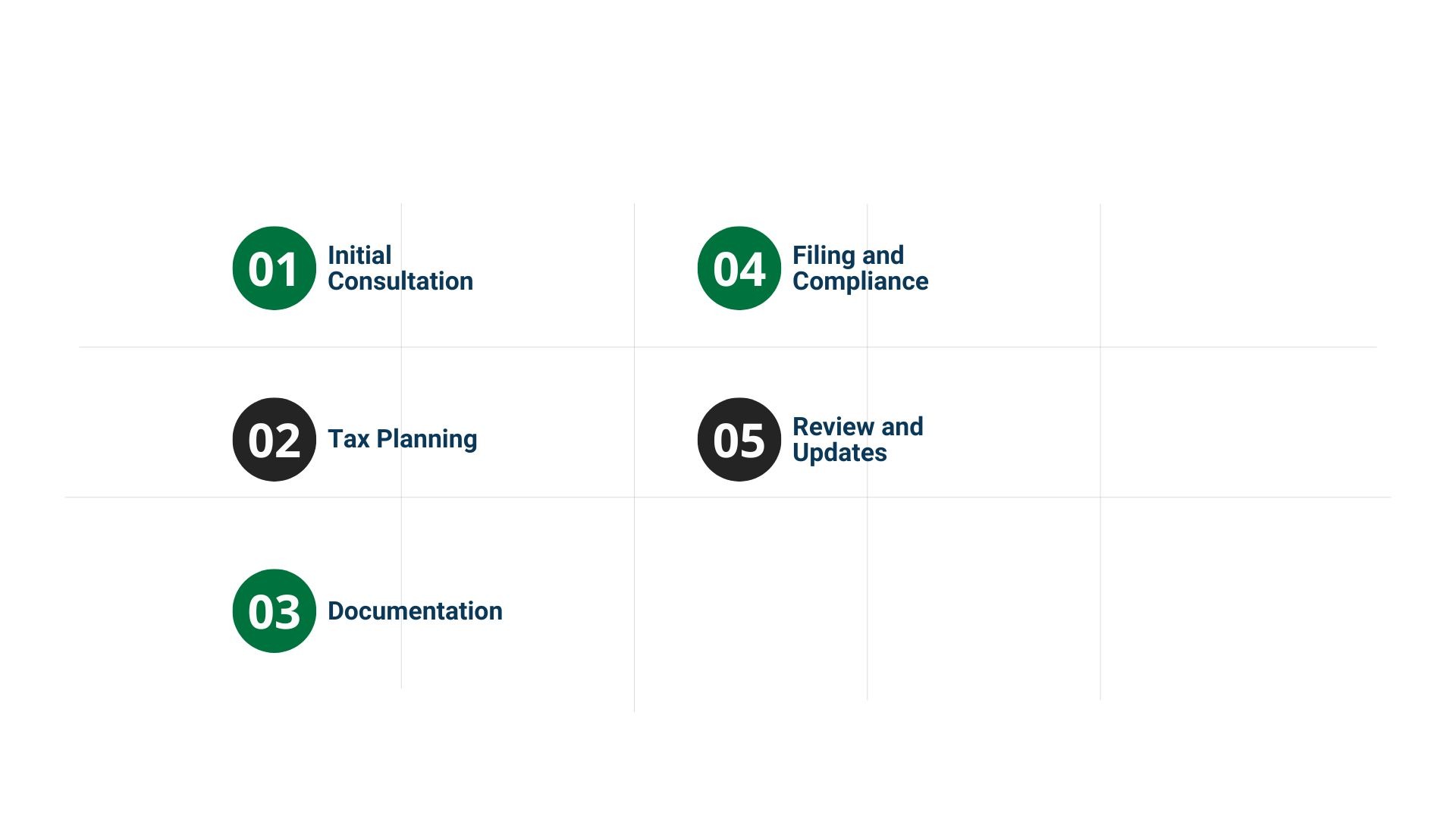

Steps for Taxation Services:

Navigating the complexities of taxation is crucial for business sustainability. IRA Consultants ensures compliance with tax regulations while identifying opportunities to reduce liabilities and enhance financial efficiency, empowering businesses to focus on growth.