Comprehensive Tax Solutions by IRA Consultants

At IRA Consultants, we specialize in offering tailored tax solutions to individuals, businesses, and corporations, ensuring compliance, minimizing liabilities, and maximizing tax benefits. We understand the challenges you face with ever-evolving tax laws, and we are here to resolve them effectively.

Personal Taxation: Simplifying Your Tax Obligations

Managing personal taxes can be overwhelming, especially for individuals with diverse income streams or insufficient knowledge of current tax policies. This often leads to missed opportunities for tax savings or unnecessary penalties.

How IRA Consultants Can Help:

- Strategic Tax Planning: We analyze your financial situation to help you claim all applicable exemptions and concessions.

- Compliance Services: Our team handles all necessary correspondence with tax authorities to ensure your compliance.

- Tax Optimization: We provide personalized strategies to minimize your tax liability and maximize savings.

- Record Management: Leave the hassle of maintaining tax records to us, so you can focus on your goals.

Indirect Taxes: Reducing the Burden on Businesses

Navigating indirect taxes such as GST, Sales Tax, and Federal Excise Duty can be complex and time-consuming. Improper planning may lead to higher tax liabilities, hurting your business.

How IRA Consultants Can Help:

- Efficient Filing Services: We ensure accurate and timely filing of tax returns.

- Tax Planning for Benefits: We help identify ways to reduce indirect tax exposure and secure refunds where applicable.

- Regulatory Compliance: Our experts guide you in adhering to all relevant indirect tax laws and regulations.

- Representation: If disputes arise, we represent your case before tax authorities, the Federal Board of Revenue (FBR), and courts to protect your interests.

Corporate Taxation: Maximizing Corporate Benefits

Corporate taxes often become a significant financial drain due to a lack of expertise in understanding tax circulars and policies. Businesses without strategic tax planning risk missing out on key benefits.

How IRA Consultants Can Help:

- Comprehensive Advisory Services: From determining tax exemptions to handling withholding tax matters, we’ve got you covered.

- Tax Refunds & Disbursements: We manage all aspects of claiming refunds, ensuring timely disbursals.

- Custom Strategies: Our consultants develop tailored plans to reduce your corporate tax burden while staying compliant with regulations.

- Streamlined Processes: We take charge of tax return filings, record-keeping, and correspondence with tax authorities, so your business operations remain uninterrupted.

- Legal Representation: Whether it’s a field audit or a court appeal, we provide strong representation to safeguard your interests.

Why Choose IRA Consultants?

- Expertise You Can Trust: With years of experience in tax law and accounting, our team ensures precision and compliance at every step.

- Tailored Solutions: We don’t believe in one-size-fits-all; we develop personalized strategies to meet your unique needs.

- Time & Cost Efficiency: Save valuable time and resources by allowing our experts to manage your taxation requirements.

At IRA Consultants, we don’t just provide services – we deliver peace of mind by handling all your tax-related concerns with professionalism and care. Let us help you achieve financial clarity and compliance today.

Contact Us Now to Discuss Your Tax Solutions.

We go beyond basic tax filing, providing expert advice on minimizing liabilities and seizing available tax benefits. By staying updated on ever-changing tax laws, we ensure that your financial strategies remain compliant and advantageous. At IRA Consultants, your taxation matters are handled with precision and care, allowing you to focus on your goals.

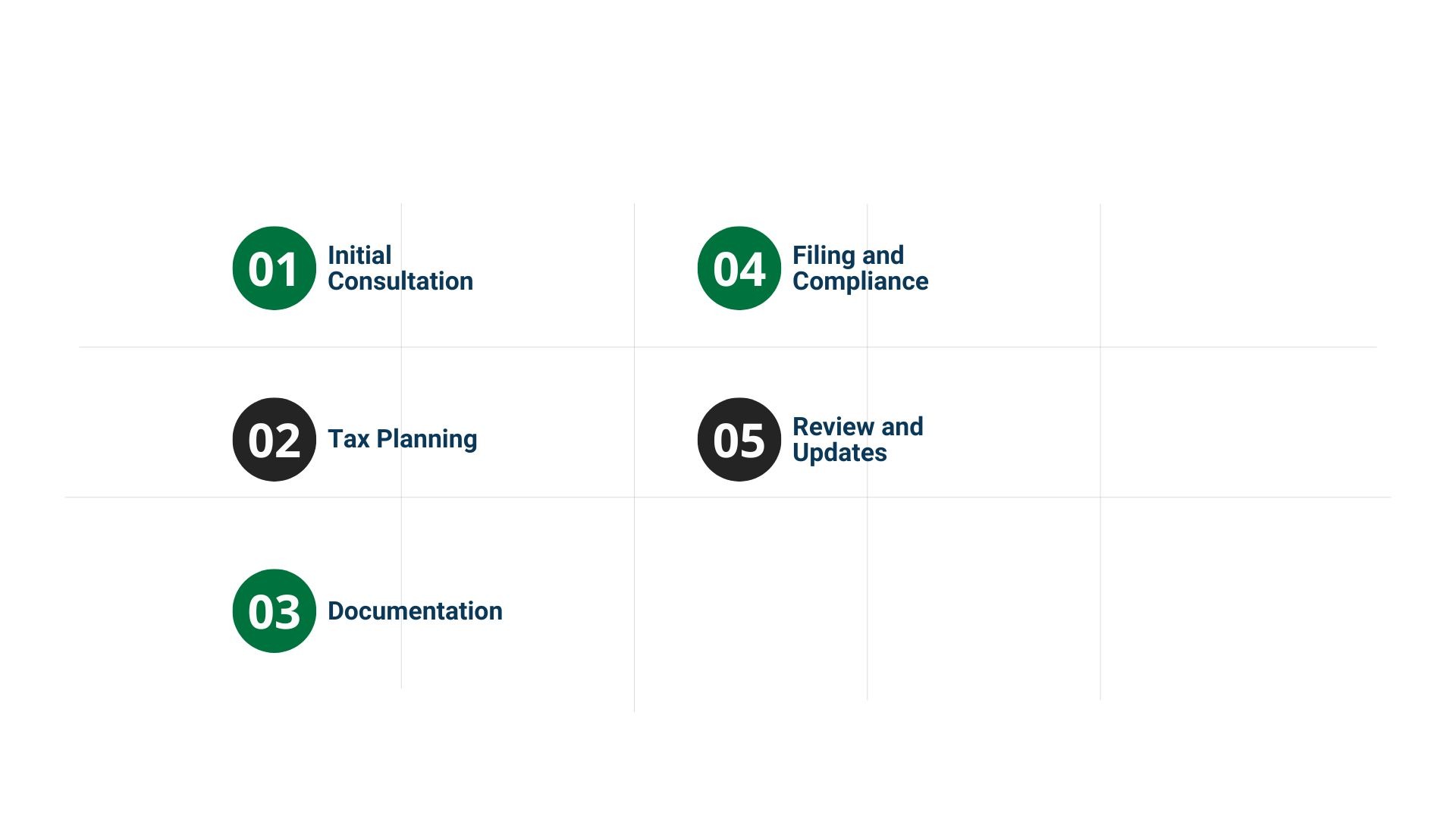

Steps for Taxation Services:

Navigating the complexities of taxation is crucial for business sustainability. IRA Consultants ensures compliance with tax regulations while identifying opportunities to reduce liabilities and enhance financial efficiency, empowering businesses to focus on growth.